RCM is applicable on renting of commercial property by unregistered persons w.e.f. 10.10.2024

Effective October 10, 2024, the Reverse Charge Mechanism (RCM) under the GST framework now applies to the renting of commercial properties by unregistered persons. This important update is designed to enhance tax compliance and ensure that unregistered property owners also contribute to the GST system when leasing commercial spaces.

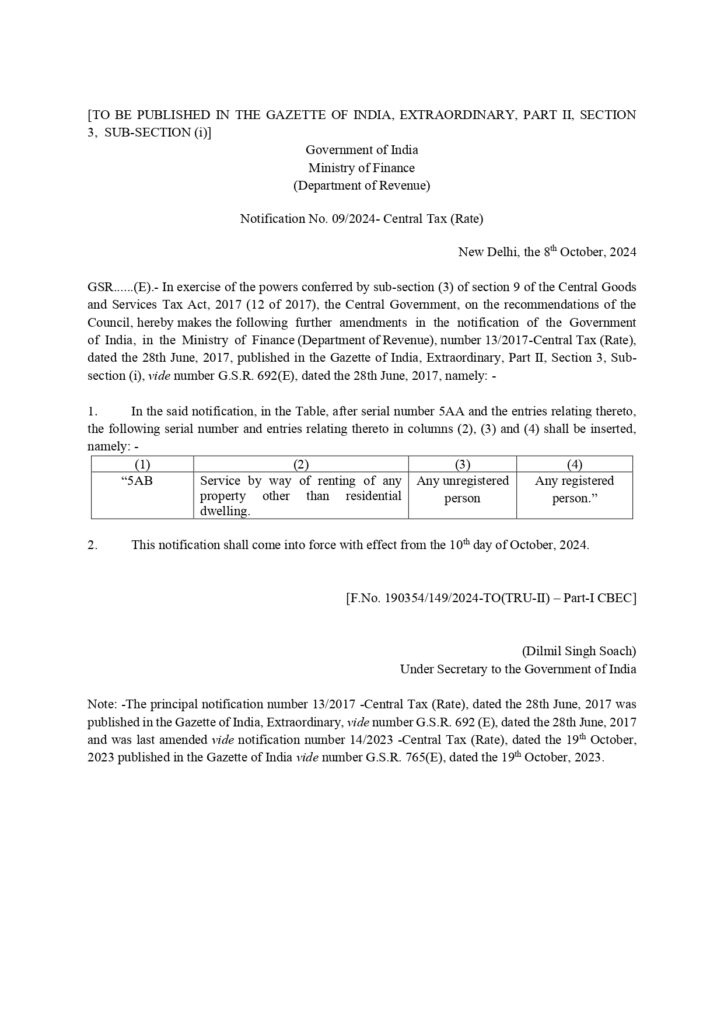

Notification No. 09/2024 – Central Tax (Rate)

Dated: October 8, 2024

Ministry of Finance – Department of Revenue

G.S.R. 623(E).—In exercise of the powers granted under sub-section (3) of Section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, based on the recommendations of the GST Council, hereby introduces further amendments to Notification No. 13/2017 – Central Tax (Rate), dated June 28, 2017, which was originally published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) under G.S.R. 692(E).

This notification shall be effective from the 10th of October, 2024.

[F. No. 190354/149/2024-TO(TRU-II) – Part-I CBEC]

Conclusion:

The extension of the Reverse Charge Mechanism (RCM) to include the renting of commercial properties by unregistered persons marks a significant step towards greater tax compliance and accountability under the GST regime. With effect from October 10, 2024, as per Notification No. 09/2024 – Central Tax (Rate), this change ensures that the burden of GST on such transactions will be shifted to the recipient of the service, typically a registered business entity. It is crucial for businesses and property owners to stay informed and align their practices with these updated provisions to avoid any compliance issues. Stay tuned to our blog for more updates and insights on evolving GST regulations.